Digital Invoicing System – Introduction

Managing taxes is no longer just about paperwork and spreadsheets. With the latest move from the Federal Board of Revenue, many businesses in Pakistan are now expected to adopt a digital invoicing system. If your business deals with fast-moving consumer goods (FMCGs), this guide will walk you through the new requirements in a clear, easy-to-follow way.

FBR Launched New Digital Invoicing System. It isn’t just a technical update. It’s designed to make tax filing simpler, reduce the chances of errors, and keep everything transparent for both businesses and the government.

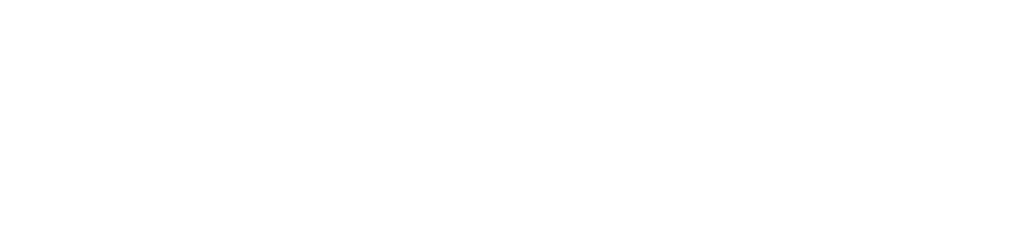

What Is FBR’s Digital Invoicing System?

Think of it as a live, digital register of your sales. Instead of manually keeping invoice records, your system will send invoice data straight to FBR in real time. This helps the authorities keep track of business transactions and ensures better compliance. It’s also a cleaner, faster way for you to manage your records.

The traditional method of printing or physically storing invoices is no longer enough if your business falls under the mandatory categories. The good news is, switching to digital makes things smoother in the long run.

Read more at Digital Invoicing User Manual.

Which Businesses Are Required to Use It?

If your work involves producing, importing, distributing, or selling FMCGs, then you likely fall under the businesses required to use this invoicing platform. These items are the everyday essentials, like food, drinks, cleaning products, and personal care items, that move quickly through retail and wholesale markets.

This system applies whether you’re a retailer, wholesaler, manufacturer, or a combination of any of these. So, if you’re already registered with the FBR and your operations involve these kinds of products, then digital integration is no longer optional.

Deadline to Integrate with the System

FBR has rolled out a clear schedule for businesses; check Extension for Integration.

In summary, it says that corporate businesses must integrate their invoicing systems by June 1, 2025, while non-corporate businesses are expected to do so by July 1, 2025. Delaying integration could lead to penalties or notices that may disrupt your operations.

The sooner you get started, the easier the process will be.

How to Get Started Without Getting Overwhelmed

At first glance, integrating a billing system with a government portal might sound a bit overwhelming. But FBR has laid out a structured way to do it. Here’s how it typically goes:

First, Know the Requirements

Digital invoices need to meet specific criteria. They should contain complete buyer and seller details, invoice numbers, transaction values, and correct tax codes. Make sure your software supports these fields and can generate them properly. You should also know the Digital Invoicing Rules.

Next, Check Your Eligibility

Even though this initiative targets the FMCG sector, it’s best to confirm whether your business falls into the required categories. FBR’s list of eligible businesses is available on their website. If unsure, you can check Registered Persons Required to Integrate, or speak to your financial consultant or accountant.

Then, Choose a Trusted Integration Partner

To connect your software to FBR’s system, you’ll need help from an authorized service provider. A few recognized names include PRAL, Haball, WebDNAworks, and EY Pakistan. These professionals understand how to set up the link between your software and FBR’s invoicing platform.

Benefits of Moving to Digital Invoicing

Going digital is not just about following rules. It’s also a smart business move. Here’s why:

It cuts down manual errors, saves time spent on paperwork, and ensures your tax filings are more accurate. When your invoices are sent automatically, your records stay clean and ready for audits. It also makes it easier to track your business performance because all sales data is well organized.

Mistakes to Avoid While Setting Up

Integration might seem simple, but avoid these common pitfalls:

Trying to rush the setup at the last minute, choosing service providers without checking their credentials, or ignoring the formatting rules required by FBR. Make sure to test everything properly before you go live. A little care at the start can save you a lot of trouble later.

What Happens If You Don’t Comply?

Not integrating your system by the given deadlines could invite penalties under the sales tax law. Your business might be flagged for audits, and you could lose some of your tax benefits. It can also disrupt how you claim refunds or manage input tax adjustments.

Simply put, staying non-compliant might hurt more than it saves.

Where to Get Support

Help is available if you need it. Many billing software companies already offer support for integration. FBR’s website also has Digital Invoicing API Documentation. If you’re working with an accountant or tax advisor, they can guide you step-by-step.

Why Acting Early Matters

This shift to digital invoicing is a positive one. It encourages better financial hygiene for businesses and ensures more consistent tax practices. Acting early gives you more time to adjust, fix any technical issues, and test your setup without rushing.

It also shows your customers and partners that your business operates professionally and transparently.

Frequently Asked Questions (FAQs)

Is Digital Invoicing Mandatory For All Businesses?

No, only businesses involved in manufacturing, importing, or selling FMCGs need to follow these rules.

Is There An FBR App I Need To Download?

No, the system is web-based. Your invoicing software will connect to FBR through official API integration.

What Is The Difference Between an E-invoice And a Digital Invoice?

They both refer to invoices sent electronically through a government-approved system. There’s no difference in how they’re used.

Can I Still Use My Old Billing System?

Yes, but only if it supports integration with FBR’s platform. Otherwise, you may need to upgrade.

Where Can I Get Help If I Face Issues?

Reach out to your billing software provider, consult your tax advisor, or visit FBR’s official site for step-by-step guides.

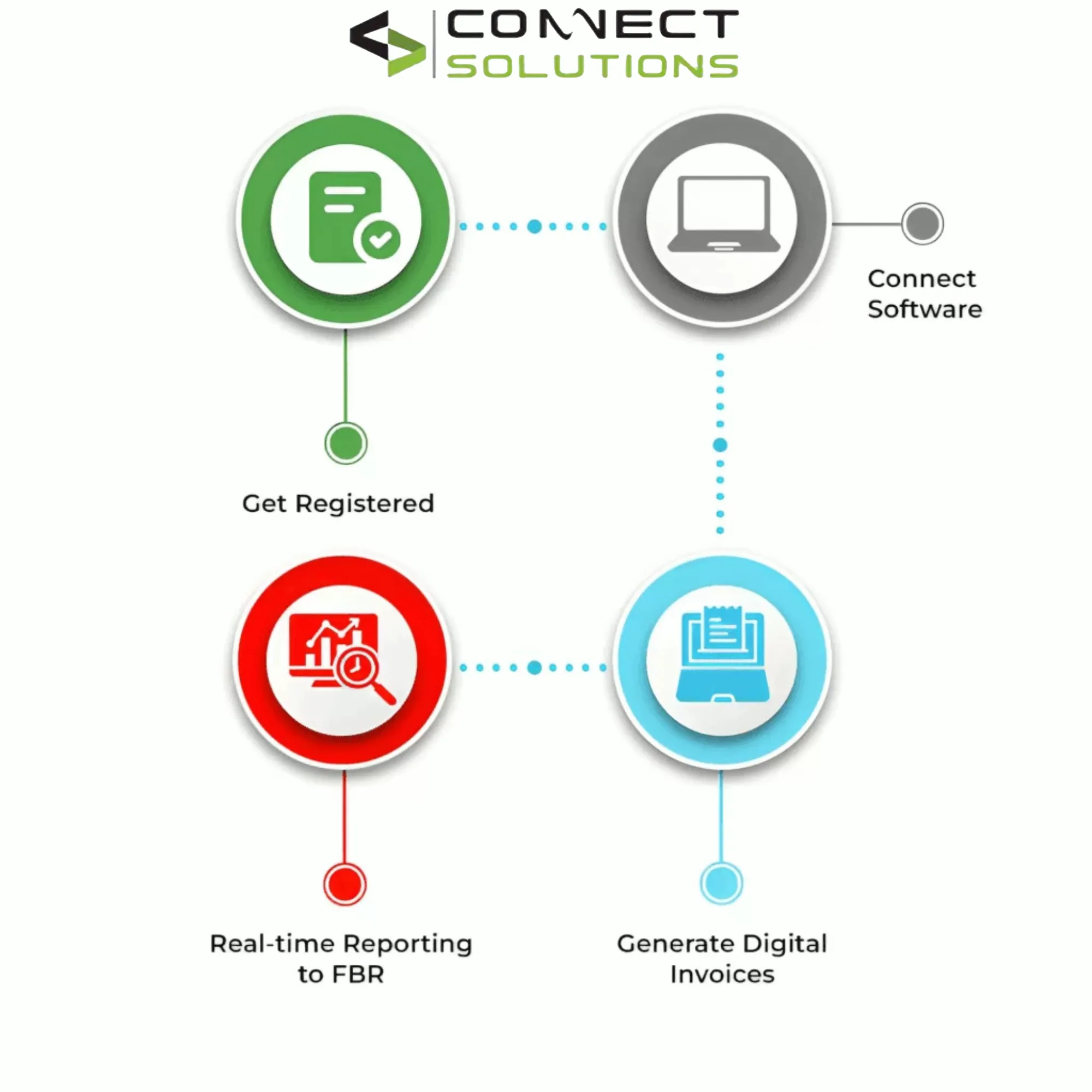

What is the FBR Digital Invoicing System, and how can Connect Solutions help?

The FBR Digital Invoicing System is a government-mandated solution in Pakistan that ensures businesses issue electronic invoices compliant with tax regulations. It helps streamline VAT reporting, reduce manual errors, and improve transparency. At Connect Solutions, we offer a reliable digital invoicing system that seamlessly integrates with your existing processes—ensuring FBR compliance, automation, and real-time reporting. Let us help you digitize your invoicing with ease.